Our Mission is to deliver exemplary services by providing financial education, training, and access to capital to support sustainable business and community development while improving the quality of life within our communities.

Are you working towards home ownership? We now offer one-on-one and classroom teaching to prepare for home ownership. Our new mortgage loan is our FAMILY ROOTS HOME LOAN. Call today to get started!

Welcome to FNCF

First Nations Community Financial is a state chartered not-for-profit Native Community Development Financial Institution (CDFI)

We are so much more than just a loan! First Nations Community Financial provides opportunities for members of the Native Community. It also makes available financial education and coaching, credit counseling, technical support and other programs and services exclusively for Community members. First Nations Community Financial currently partners with the Ho-chunk Nation and Ho-Chunk Housing and Community Development Agency to provide a wide range of financial products and services for the Communities and its members. Nationally, more than 70 Native Community Development Financial Institutions (CDFIs) exist in Indian Country. However, First Nations Community Financial is unique because it is the only Native CDFI that puts all its financial services to serve more communities than any other.

Wooruwi Business Program

The Wooruwi Business Program is available to all Native American Entrepreneurs in the State of Wisconsin. Whether you are a start-up, developing your business, or expanding your business, we have something for everyone. Ask about how you may be eligible for up to 50% forgiveness on your business loan when you complete the program.

Homeownership Program

The Homeownership mortgage products are available to Ho-Chunk Nation tribal members only, however our educational courses are for everyone and our HUD certified courses will help you meet your Housing Education requirements.

*Due to the success of this program we have exhausted our funding and can no longer offer this loan product at this time. We do still offer HUD certified courses.

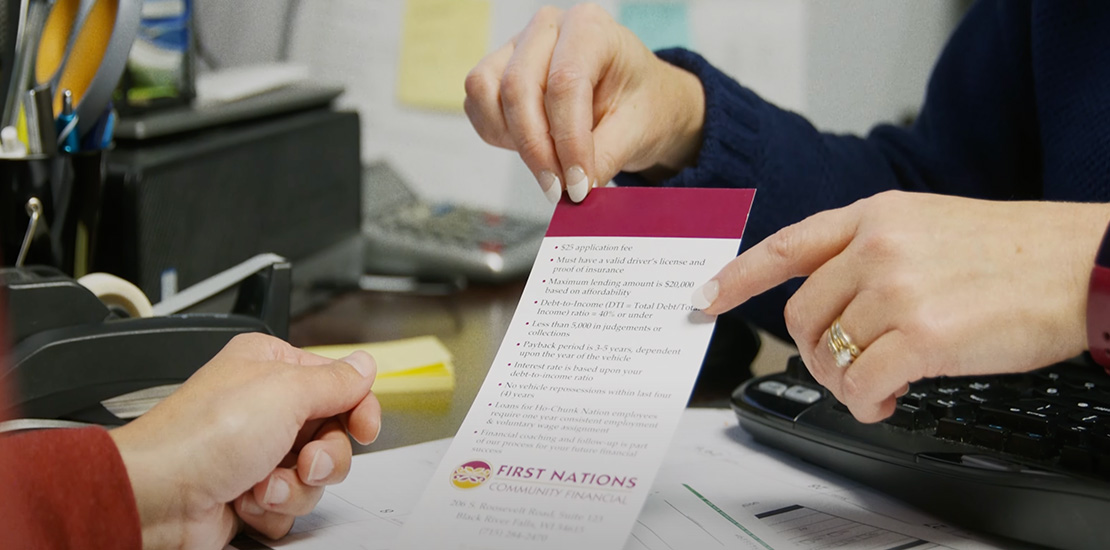

Consumer Loan Programs

Our personal loan products are very diverse and we have everything including personal loans, emergency loans, auto loans, fresh start loans, and holiday loan products. If you are not sure which product fits your needs – please feel free to click the “Learn More” button below to find out which loan product best suits your needs. We look forward to working with you and helping to meet your financial needs.

*Temporary suspension of auto loans*

Indianpreneurship Classes

This is a small business planning course to assist participants in developing a business plan. Topics include marketing, location, types of ownership, finances, and business identity. Completion of this class is required to take out a small business loan with FNCF.

HUD-approved Services

HUD (U.S. Department of Housing and Urban Development) approved counselors are professionals who have been certified by HUD to provide housing counseling services. These counselors are trained to assist individuals and families with various housing-related issues, such as buying a home, renting, avoiding foreclosure, and managing finances related to housing. If you feel you could benefit from meeting with one of our counselors, please click below to learn more about the services we offer.

Financial Coaching Services

Understanding your personal finances is an empowering experience. Attending a session with one of our financial coaches is giving yourself the gift of financial freedom and control. Imagine gaining insights into budgeting, saving strategies, and credit building options tailored to your unique goals. A financial coach can provide guidance, demystify complex concepts, and offer practical tips to help you navigate the intricacies of money management. Empower yourself with knowledge, and pave the way for a more secure and prosperous financial future!

Loan Inquiry

Please watch this video to help you through the application process.

Testimonials

First Nations Community Financial is a state chartered not-for-profit Native Community Development Financial Institution (CDFI)

206 S Roosevelt Rd, Suite 123 Black River Falls, WI 54615

Quick Links

- Home

- About Us

- Job Postings

- Our Services

- Educational Services

- Contact

- Loan Inquiry

Upcoming Events

- Lunch & Learn - HCG-Madison - April 9, 2025

- Indianpreneurship - Virtual - April 11, 2025

- Dreaming To Reality Summit - April 22 & 23, 2025

- Lunch & Learn - Wednesday, April 30 - HCN Milwaukee Branch Office

Office Hours (8-4:30 M-F)

Closed on the Following Holidays

- New Year's Day (Jan 1st)

- Memorial Day (Last Monday in May)

- Mitchell Red Cloud Jr. Day (July 4th)

- Labor Day (First Monday in Sept.)

- Veterans Day ( November 11th)

- Thanksgiving (4th Thursday in Nov.)

- Ho-Chunk Day (Day after Thanksgiving)

- Christmas Eve (December 24th)

- Christmas (December 25th)

- New Year's Eve (December 31st)

Connect with us

- Email: [email protected]

- Phone: (715) 284-2470

- Fax: (715) 284-2471

*This institution is an equal opportunity provider. In accordance with federal law and U.S. Department of the Treasury policy, this institution is prohibited from discriminating on the basis of race, color, national origin, sex, age, or disability. To file a complaint of discrimination, write to Department of the Treasury, Office of Civil Rights and Diversity, 1500 Pennsylvania Ave. NW, Washington, D.C. 20220 or call (202) 622-1160.